Business Insurance in and around Lowville

One of Lowville’s top choices for small business insurance.

No funny business here

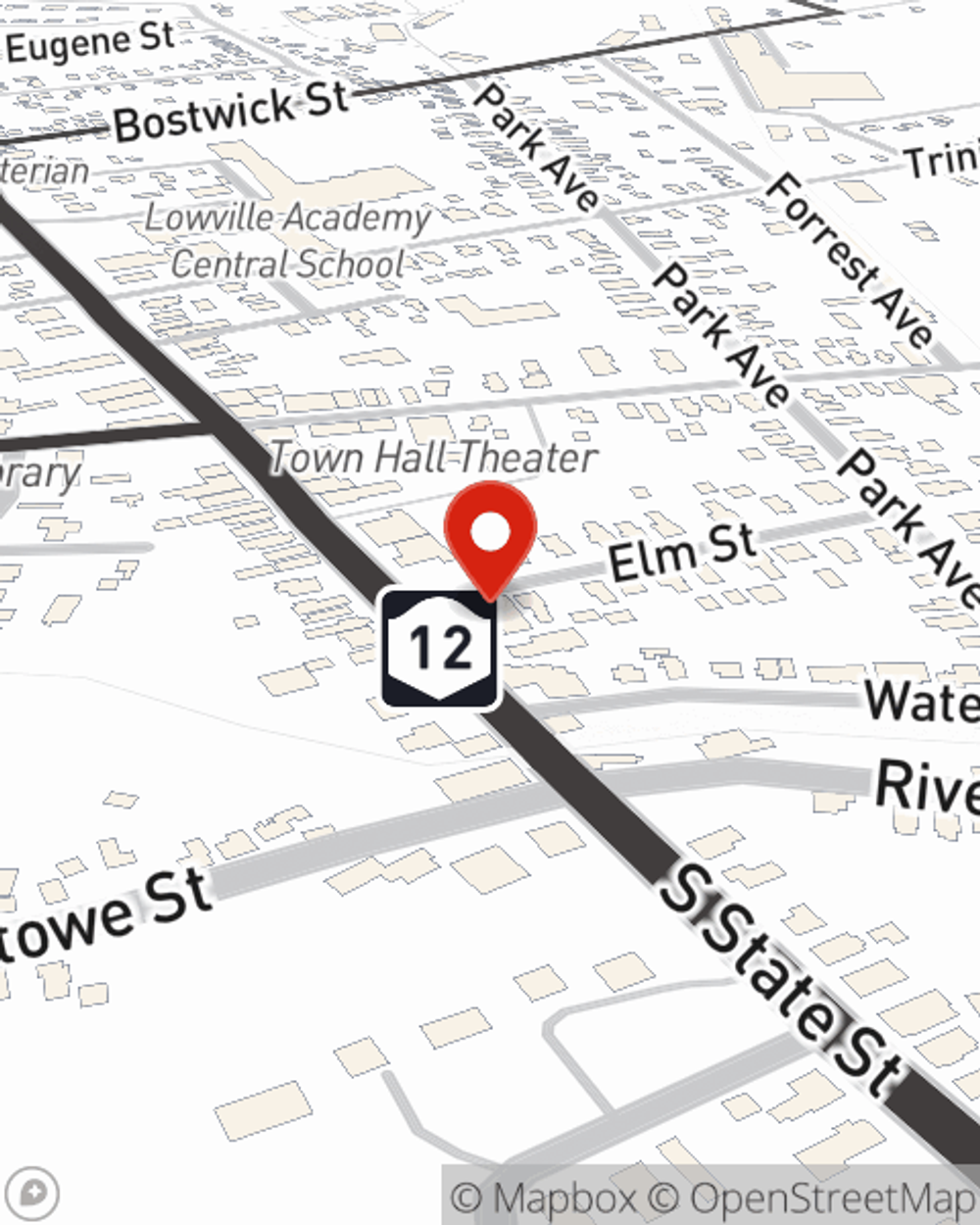

- Lowville, NY

- Watertown, NY

- Carthage, NY

- Boonville, NY

- Fort Drum, NY

- Lewis County, NY

- New York

- Harrisville, NY

- Jefferson County, NY

State Farm Understands Small Businesses.

You may be feeling like there is so much to do with running your small business and that you have to handle it all alone. State Farm agent Tom Spaulding, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of Lowville’s top choices for small business insurance.

No funny business here

Get Down To Business With State Farm

For your small business, whether it's a clock shop, a shoe store, a travel agency, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, computers, and loss of income.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Call or email State Farm agent Tom Spaulding's team today to get started.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tom Spaulding

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.